Giorgio Armani | The End of an Era & The Future of a Fashion Empire

Giorgio Armani, the legendary Italian fashion designer who revolutionized modern luxury, passed away at age 91, leaving behind one of fashion's last great independent empires. Known for democratizing power dressing and creating timeless elegance, Armani built a $7.4 billion brand that now faces critical decisions about its future. While his deconstructed suits and lifestyle branding philosophy transformed the industry, the brand struggles with outdated business models and changing consumer preferences. As the Giorgio Armani Foundation assumes control, the fashion world watches to see whether this iconic house can modernize while preserving the founder's legacy of sophisticated, wearable luxury.

#GiorgioArmani, #ArmaniLegacy, #LuxuryFashion, #ItalianFashion, #PowerDressing, #FashionHistory, #LuxuryBusiness, #QuietLuxury, #FashionEmpire, #Tailoring, #Milan, #FashionIcon, #LuxuryBrands, #FashionIndustry, #Elegance, #Menswear, #Womenswear, #RedCarpet, #AmericanGigolo, #FashionLegend, #ModernLuxury, #FashionBusiness, #IndependentFashion, #Craftsmanship, #TimelessLuxury

The Luxury Consumer Revolt | When Exclusivity Becomes Exclusion

Fifty million luxury consumers abandoned the market as prices rose 52% since 2019, validating our strategic analysis. Shopping became bureaucratic rather than enjoyable, creating "greedflation" backlash. This explains why focused authentic luxury and accessible premium succeed while confused positioning fails. Digital disruption made scarcity meaningless, consumers shifted to experiential wealth, and alternatives emerged from vintage to "dupes." Consumer choice now determines luxury strategy success.

#LuxuryConsumers, #ConsumerRevolt, #Greedflation, #LuxuryPricing, #AuthenticLuxury, #LuxuryStrategy, #ConsumerBehavior, #ExperientialWealth, #LuxuryBacklash, #DigitalDisruption, #StatusSymbols, #DupeCulture, #VintageLuxury, #ConsumerChoice, #LuxuryRecovery, #BrandAuthenticity, #LuxuryFuture, #ConsumerEmpowerment

Preview | The Psychology of Resale Shopping | The Gamification of Shopping

The resale shopping industry has revolutionized consumer behavior by implementing sophisticated gamification strategies that transform purchasing into an addictive, game-like experience. Through psychological mechanisms including artificial scarcity, variable reward systems, and competitive dynamics, resale platforms have created an entertainment-driven shopping ecosystem that has disrupted traditional retail. With 47% of consumers now considering resale value in purchase decisions, this shift represents a fundamental change in how people approach shopping—from simple consumption to strategic investment and competitive engagement.

#resaleshopping, #gamification, #consumerpsychology, #luxuryresale, #shoppingstudy, #markettrends, #retaildisruption, #secondhandluxury, #shoppingbehavior, #consumertrends, #psychologyofshapping, #retailpsychology, #fashionresale, #sustainablefashion, #circulareconomy, #vintageshopping, #luxurymarket, #onlineshopping, #dopamineshopping, #shoppingaddiction

The Psychology of Resale Shopping | The Gamification of Shopping

The resale shopping industry has revolutionized consumer behavior by implementing sophisticated gamification strategies that transform purchasing into an addictive, game-like experience. Through psychological mechanisms including artificial scarcity, variable reward systems, and competitive dynamics, resale platforms have created an entertainment-driven shopping ecosystem that has disrupted traditional retail. With 47% of consumers now considering resale value in purchase decisions, this shift represents a fundamental change in how people approach shopping—from simple consumption to strategic investment and competitive engagement.

#resaleshopping, #gamification, #consumerpsychology, #luxuryresale, #shoppingstudy, #markettrends, #retaildisruption, #secondhandluxury, #shoppingbehavior, #consumertrends, #psychologyofshapping, #retailpsychology, #fashionresale, #sustainablefashion, #circulareconomy, #vintageshopping, #luxurymarket, #onlineshopping, #dopamineshopping, #shoppingaddiction

Preview | Lululemon Lesson | How Athleisure King's Stumble Reveals the Fragile Nature of Fashion Dominance

Lululemon's 2025 struggles illustrate how quickly premium fashion brands can fall from grace when multiple challenges converge. The athleisure giant faces declining sales as fashion trends shift toward baggy styles, core customers reject new product lines, and economic pressures make luxury athletic wear less appealing. Combined with supply chain vulnerabilities, increased competition, and the commoditization of technical athletic wear, Lululemon's premium positioning is under serious threat. The company's experience offers critical lessons about maintaining cultural relevance, authentic growth strategies, and the fragility of fashion dominance in an increasingly volatile retail landscape.

#Lululemon, #Athleisure, #PremiumBrands, #FashionTrends, #RetailStrategy, #BrandStrategy, #AthleticWear, #Activewear, #FashionBusiness, #RetailAnalysis, #BrandManagement, #ConsumerTrends, #LuxuryRetail, #Sportswear, #BusinessStrategy, #MarketingStrategy, #FashionIndustry, #RetailTrends, #BrandPositioning, #ConsumerBehavior

The Lululemon Lesson | How Athleisure King's Stumble Reveals the Fragile Nature of Fashion Dominance

Lululemon's 2025 struggles illustrate how quickly premium fashion brands can fall from grace when multiple challenges converge. The athleisure giant faces declining sales as fashion trends shift toward baggy styles, core customers reject new product lines, and economic pressures make luxury athletic wear less appealing. Combined with supply chain vulnerabilities, increased competition, and the commoditization of technical athletic wear, Lululemon's premium positioning is under serious threat. The company's experience offers critical lessons about maintaining cultural relevance, authentic growth strategies, and the fragility of fashion dominance in an increasingly volatile retail landscape.

#Lululemon, #Athleisure, #PremiumBrands, #FashionTrends, #RetailStrategy, #BrandStrategy, #AthleticWear, #Activewear, #FashionBusiness, #RetailAnalysis, #BrandManagement, #ConsumerTrends, #LuxuryRetail, #Sportswear, #BusinessStrategy, #MarketingStrategy, #FashionIndustry, #RetailTrends, #BrandPositioning, #ConsumerBehavior

Preview | The American Luxury Renaissance - A Different Path to Success

American luxury brands Coach and Ralph Lauren are outperforming struggling European rivals with +50%+ stock gains and double-digit sales growth. They succeeded by maintaining accessible pricing ($200-$500) while European brands priced themselves out of reach, capturing young consumers and growing strongly in China. This reveals a three-tier luxury hierarchy: ultra-luxury focused (Hermès), accessible luxury done right (Americans), and confused middle (struggling Europeans). Strategic clarity beats geographic heritage.

#AmericanLuxury, #LuxuryBrands, #Coach, #RalphLauren, #Tapestry, #LuxuryStrategy, #AccessibleLuxury, #EuropeanLuxury, #LuxuryMarket, #BrandStrategy, #LuxuryTiers, #YoungConsumers, #GenZ, #Millennials, #PricingStrategy, #LuxuryGrowth, #ChinaLuxury, #TradingDown, #BrandPositioning, #LuxuryRetail, #MarketShare, #LuxuryStocks, #FashionBusiness, #LuxuryIndustry, #LuxuryConsumers, #BrandInvestment, #MarketingStrategy, #LuxuryCompetition, #StrategicClarity, #BrandDifferentiation, #LuxuryValuation, #GlobalLuxury, #LuxuryExpansion, #ConsumerBehavior, #LuxuryTrends, #IndustryAnalysis, #LuxuryPerformance, #AmericanBrands, #LuxuryRevival, #StrategicFocus

The American Luxury Renaissance | A Different Path to Success

American luxury brands are surging while European counterparts struggle, revealing a new competitive dynamic in the luxury landscape. Tapestry (Coach) and Ralph Lauren have delivered exceptional stock returns (+55% and +29% respectively in 2025) and strong sales growth (+13% and +11%), while European brands averaged -3% decline.

This divergence highlights a three-tier luxury hierarchy: ultra-luxury focused brands (Hermès, Brunello Cucinelli) succeeding at the top, accessible luxury done right (American brands) winning in the middle market, and confused European brands struggling between strategies. American brands succeeded by maintaining disciplined pricing ($200-$500 sweet spot vs. European brands going 10x higher), targeting young consumers abandoned by price-aggressive Europeans, and investing heavily in brand building (up to 10% of sales on advertising). They're capturing customers who were "priced out" of European luxury, with significant growth in China (+30% for Ralph Lauren, +22% for Coach) as consumers "trade down" to affordable luxury.

European brands face a strategic dilemma: double down on ultra-luxury exclusivity or compete for accessible luxury they inadvertently abandoned. The success demonstrates that strategic clarity and consistent execution matter more than geographic origin - whether choosing ultra-luxury or accessible luxury, confusion in the middle satisfies no one.

#AmericanLuxury, #LuxuryBrands, #Coach, #RalphLauren, #Tapestry, #LuxuryStrategy, #AccessibleLuxury, #EuropeanLuxury, #LuxuryMarket,

Preview | The Focused Luxury Playbook - How Exclusivity Breeds Success

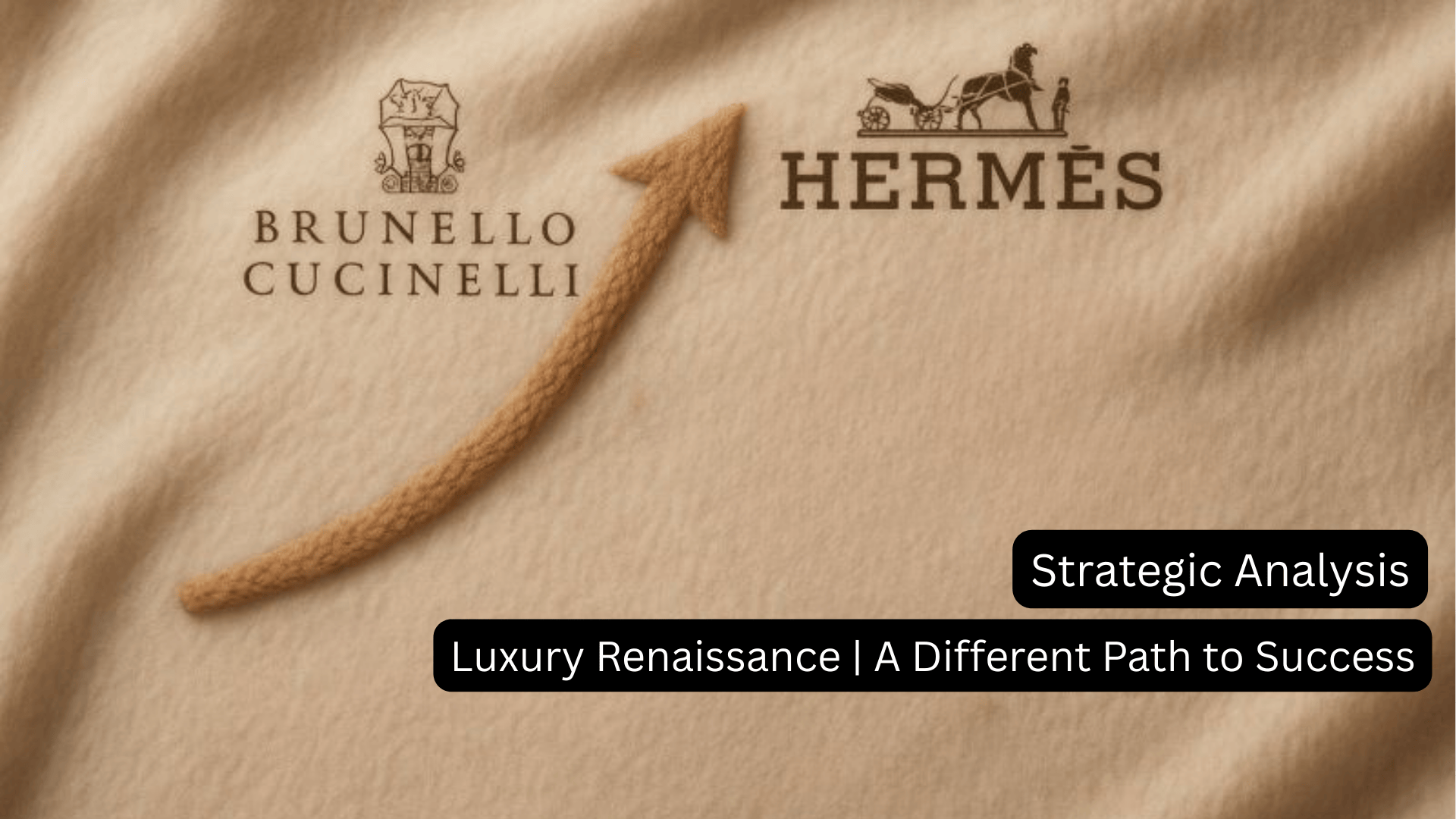

In our recent exploration of the luxury industry's strategic crossroads, we examined how two contrasting approaches—LVMH's diversified conglomerate model versus Hermès' focused ultra-luxury strategy—are producing dramatically different market results. We discussed how the industry faces a fundamental choice between democratization and exclusivity, with the market increasingly rewarding focused approaches over diversified expansion. Now, fresh earnings results from Brunello Cucinelli provide compelling real-time validation of this focused luxury thesis in action.

#luxury, #brunellocucinelli, #hermes , #luxuryindustry, #luxurytrends, #luxurybusiness, #focussedluxuryplaybook, #luxurybusinessstrategy

The Focused Luxury Playbook - How Exclusivity Breeds Success

In our recent exploration of the luxury industry's strategic crossroads, we examined how two contrasting approaches—LVMH's diversified conglomerate model versus Hermès' focused ultra-luxury strategy—are producing dramatically different market results. We discussed how the industry faces a fundamental choice between democratization and exclusivity, with the market increasingly rewarding focused approaches over diversified expansion. Now, fresh earnings results from Brunello Cucinelli provide compelling real-time validation of this focused luxury thesis in action.

The luxury industry's strategic realignment continues, and focused players like Cucinelli are writing the playbook for sustainable luxury success in an increasingly complex global market.

#luxury, #brunellocucinelli, #hermes , #luxuryindustry, #luxurytrends, #luxurybusiness

Beauty as the New Luxury Frontier: Louis Vuitton's Strategic Gambit with Pat McGrath

Louis Vuitton enters the beauty market with La Beauté collection in partnership with Pat McGrath, as luxury brands pivot to cosmetics during fashion sector slowdown. The sustainable, inclusive makeup line featuring 55 lipsticks and eyeshadow palettes represents strategic alliance between heritage luxury and beauty innovation, launching globally August 29th.

#LouisVuitton, #LaBeautéLouisVuitton, #PatMcGrath, #LuxuryBeauty, #BeautyLaunch, #LuxuryBrands, #LVMH, #SustainableBeauty, #InclusiveBeauty, #MakeupArtist, #BeautyIndustry, #LuxuryMarket, #PatMcGrathLabs, #MotherOfMakeup, #LuxuryCosmetics, #BeautyPartnership, #LVBeauty, #LuxuryLifestyle, #BeautyNews, #FashionBeauty

The Luxury Industry's Tourist Spending Crisis | When Currency Winds Change Direction

The Perfect Storm Hits Luxury

Luxury brands are facing a significant downturn as tourist spending on high-end goods plummets in Europe and Japan. Currency shifts have eliminated the financial incentives that previously drove American tourists to shop in Europe and Chinese tourists to splurge in Japan. Major players like LVMH, Prada, and Moncler reported declining sales, with LVMH's fashion division dropping 9% in Q2 2025. The US dollar's 10% decline against the euro and the yen's recovery have reversed last year's boom conditions. Combined with weak consumer confidence in China and fragile demand in the US, analysts have revised 2025 luxury industry forecasts from +5% growth to -2% decline. The crisis exposes deeper issues around aggressive pricing strategies and over-dependence on currency-driven tourist spending rather than sustainable brand value.

#LuxuryIndustry, #TouristSpending, #CurrencyFluctuation, #LVMH, #Prada, #Moncler, #LuxuryBrands, #RetailCrisis, #JapanTourism, #EuropeanRetail, #ConsumerSpending, #LuxuryMarket, #FashionIndustry, #EconomicTrends, #MarketAnalysis, #RetailTrends, #LuxuryGoods, #TravelRetail, #ChinaConsumers, #USMarket, #GlobalEconomy, #BrandStrategy, #PricingStrategy, #MarketForecast, #RetailSales, #TourismEconomy, #LuxuryConsumers, #MarketVolatility, #IndustryOutlook, #RetailAnalysis

The Luxury Industry's Strategic Crossroads | Two Diverging Paths

The luxury industry faces a strategic inflection point as two contrasting approaches diverge dramatically in market performance. LVMH's diversified conglomerate model, spanning 75 brands across multiple categories, is struggling with a 4% revenue decline and 22% profit drop, while Hermès' focused ultra-luxury strategy has made it the most valuable luxury company despite generating just €15bn versus LVMH's €85bn in sales. The market is rewarding Hermès' disciplined approach to exclusivity with valuations more than twice LVMH's relative to profits.

#LuxuryStrategy, #LuxuryIndustry, #LVMH, #Hermes, #LuxuryBrands, #PremiumPositioning, #UltraLuxury, #BrandStrategy, #LuxuryConglomerate, #ExclusivityStrategy, #LuxuryMarket, #BrandPortfolio, #PricingStrategy, #MarketValuation, #LuxuryConsumers, #BrandDilution, #Democratization, #FocusStrategy, #LuxuryTrends, #IndustryTransformation, #BernardArnault, #LuxuryRetail, #PremiumBrands, #LuxuryGoods, #MarketStrategy, #BrandPositioning, #LuxuryGrowth, #StrategicFocus, #LuxuryAnalysis, #RetailStrategy, #BrandManagement, #LuxuryEcosystem

LVMH Considers Selling Marc Jacobs | A Strategic Recalibration in a Slower Luxury Market

LVMH is exploring the sale of its Marc Jacobs brand, with potential buyers including Authentic Brands, Bluestar Alliance, and WHP Global. While Marc Jacobs has undergone recent efforts to streamline and revive its offerings, LVMH appears ready to divest brands that no longer fit its growth strategy—similar to its past exits from Off-White, Stella McCartney, and Donna Karan.

#LVMH, #MarcJacobs, #LuxuryFashion, #BrandDivestiture, #FashionMergers, #AuthenticBrands, #BluestarAlliance, #WHPGlobal, #CecileCabanis, #BernardArnault, #LuxuryRetail, #StrategicRepositioning, #Versace, #Prada, #LuxuryMarket, #MergersAndAcquisitions

Luxury at a Crossroads | LVMH’s Slump, Price Pushback, and Arnault’s Diplomatic Gamble

The luxury slowdown just got very real.

LVMH reported a 9% drop in fashion and leather goods sales — its steepest decline in years — highlighting deepening pressure across the luxury sector. Years of aggressive price hikes, post-pandemic overexpansion, and mass-market strategies have triggered consumer fatigue. The pricing power that once fueled growth is now in retreat, with average price increases slowing to 3% in 2025.

#LVMH, #LuxuryIndustry, #BernardArnault, #LuxuryRetail, #PricingStrategy, #PostPandemicTrends, #Tariffs, #LouisVuitton, #Dior, #ConsumerTrends, #BrandDesirability, #MarketReset

When Exclusivity Backfires | Tiffany, Patek, and the Perils of Luxury Bundling

A Bloomberg investigation reveals how Tiffany & Co.’s controversial handling of the limited-edition Patek Philippe “Blue Dial” watch—encouraging clients to spend millions on jewelry in hopes of securing the $52,000 timepiece—backfired. While LVMH positioned Tiffany as a turnaround success, the tactics used raise questions about how far luxury brands can go in using bundling strategies. This approach, also used by Hermès (for Birkins) and Ferrari (for limited models), may boost short-term sales but risks long-term brand equity and customer trust. As exclusivity becomes a transactional game, the luxury sector must rethink how it scales without eroding its foundations.

#LuxuryStrategy, #TiffanyAndCo, #PatekPhilippe, #LVMH, #Hermes, #Ferrari, #LuxuryBranding, #Exclusivity, #CustomerTrust, #BundlingStrategy, #Watches, #Jewelry, #CapitalCompass, #Bloomberg, #BrandEquity, #LuxuryRetail

The Burberry Rebuild Is Starting to Work — Step by Step

Burberry has begun to turn the corner under CEO Josh Schulman, with Q1 FY25 results showing stronger-than-expected performance despite continued macroeconomic challenges. Comparable store sales declined just 1% versus a 21% drop a year ago, and global conversion rates are up significantly—led by local customers rather than tourists. Strategic shifts include repositioning the brand around “timeless British luxury,” expanding pricing architecture, and launching immersive campaigns like the Highgrove and Ibiza activations. Schulman is also driving operational efficiency, including a 20% planned headcount reduction by 2027. With a 27% rise in share price year-to-date and potential re-entry into the FTSE 100, Burberry’s multiyear transformation plan appears to be gaining traction.

#Burberry, #LuxuryFashion, #JoshSchulman, #BrandTurnaround, #BritishLuxury, #RetailStrategy, #GlobalSales, #LuxuryRetail, #Q1Results, #FashionBusiness, #ConsumerTrends, #FTSE100, #ConversionRate, #LuxuryMarketing

Decoding Style | Core Fashion Marketing Strategies and Real-World Brand Case Studies

Dive deep into the vibrant world of fashion marketing with our comprehensive video guide, "Decoding Style: Core Fashion Marketing Strategies and Real-World Brand Case Studies."

This video explores six foundational strategies that top fashion brands use to captivate and connect with their audiences. From Burberry's successful rebranding to Stella McCartney's pioneering sustainable practices, we uncover the tactics and creativity behind these iconic campaigns. Whether you're a marketing professional, a fashion enthusiast, or a student of design, this video provides valuable insights into the strategic thinking that shapes the fashion industry. Join us as we analyze each strategy through real-world case studies, offering you a clear view of how theory translates into successful practice.

#FashionMarketing, #BrandStrategy, #SustainableFashion, #DigitalMarketing, #FashionIndustry, #MarketingTips, #FashionEducation, #FashionCaseStudies

Brand Identity (Preview) | Marketing, Design, and What Apple, Nike & Coca-Cola Get Right

What really makes a brand unforgettable? I

n this video, we break down Brand Identity from two essential perspectives: Marketing and Design. Whether you’re a startup crafting your identity or an established brand planning a refresh, this session will help you align your message and visuals for maximum impact.

We’ll cover: • The 4 key components of brand identity from a marketing lens (voice, values, promise, and positioning) • The 4 core elements of brand identity from a design perspective (logo, color palette, typography, and imagery) • How to bridge the gap between marketing and design for a unified brand presence • Case studies of Apple, Coca-Cola, and Nike to see theory in action

🎯 If you’re ready to move beyond theory and see how the best brands do it, this is your guide.

Understanding Brand Identity | Marketing and Design Perspectives + Case Studies

What really makes a brand unforgettable? In this video, we break down Brand Identity from two essential perspectives: Marketing and Design.

Whether you’re a startup crafting your identity or an established brand planning a refresh, this session will help you align your message and visuals for maximum impact.

We’ll cover: • The 4 key components of brand identity from a marketing lens (voice, values, promise, and positioning) • The 4 core elements of brand identity from a design perspective (logo, color palette, typography, and imagery) • How to bridge the gap between marketing and design for a unified brand presence • Case studies of Apple, Coca-Cola, and Nike to see theory in action

This is part of our ongoing series on Branding & Strategy Fundamentals — check out more on our channel or dive deeper with exclusive content at pallavisehgal.com

#BrandIdentity, #MarketingStrategy, #DesignThinking, #Apple, #Nike, #CocaCola, #BrandPositioning, #VisualBranding, #StartupBranding, #LuxuryBusiness, #BrandingFundamentals, #MarketingDesignIntegration