Preview | Term Sheet Psychology - Negotiating Win-Win Deals | Investor Edition

Building on efficient due diligence, this episode reveals how to structure deals that motivate founders while protecting investor interests. Learn the psychology behind founder decision-making during negotiations, master the key terms beyond valuation that drive long-term success, discover common negotiation mistakes that destroy relationships, and understand how to create win-win structures that align interests for maximum value creation. Perfect for investors who want to win competitive deals while setting up portfolio companies for success.

#TermSheet, #StartupNegotiation, #AngelInvesting, #VentureCapital, #DealStructure, #InvestorEducation, #StartupInvesting, #InvestmentTerms, #FounderRelations, #EarlyStageInvesting, #VCFundamentals, #StartupDeals, #InvestorTips, #DealNegotiation, #StartupFunding, #capitalcompass, #capitalcompassinvestoredition, #seriescapitalcompass, #seriescapitalcompassinvestoredition

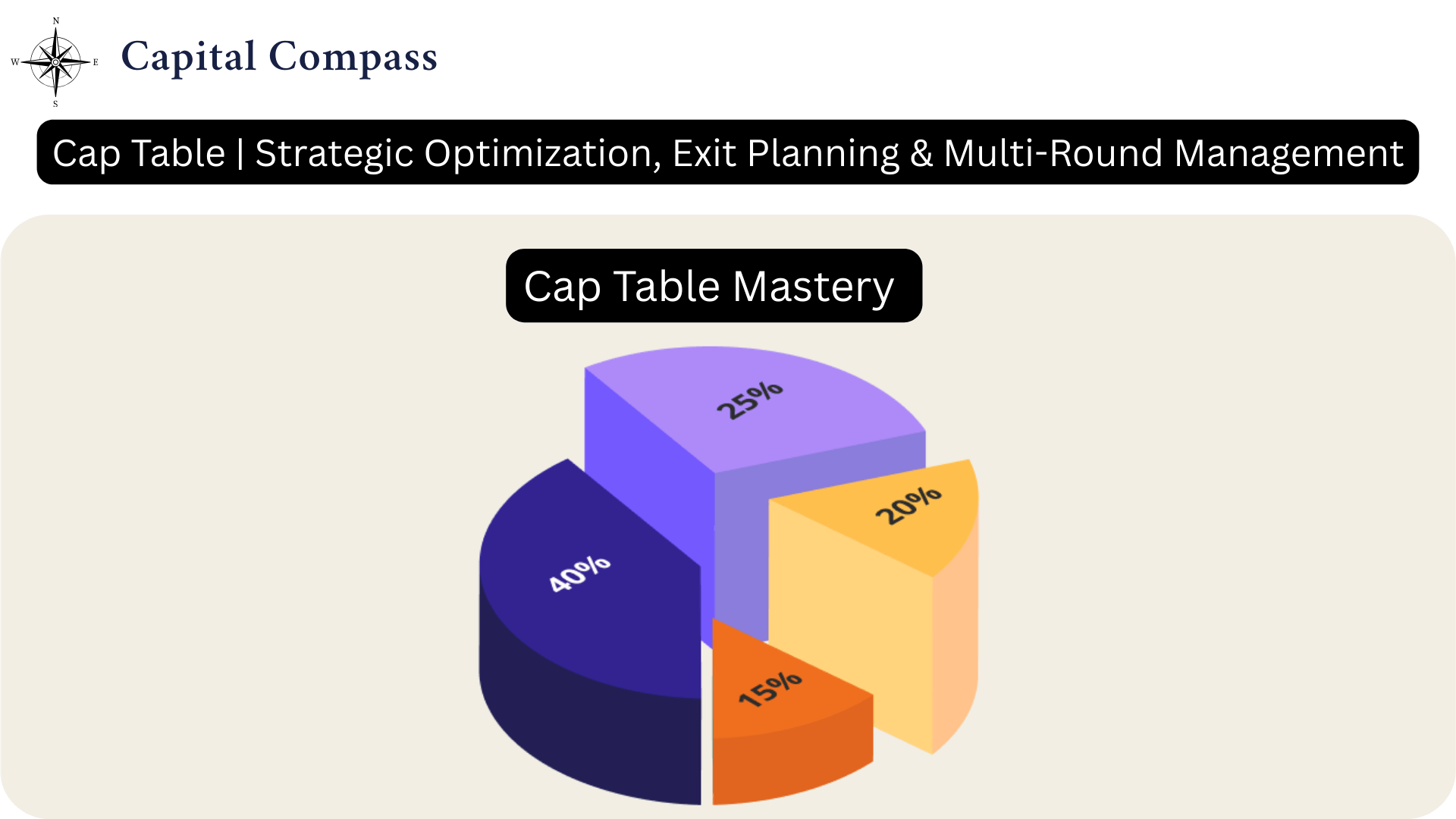

Advanced Cap Table Mastery | Strategic Optimization, Exit Planning, and Multi-Round Management

Building on cap table fundamentals, this advanced episode reveals how sophisticated founders strategically manage equity across multiple funding rounds while optimizing for maximum exit value. Learn advanced dilution modeling, discover equity negotiation strategies that preserve founder control, master complex option pool management, and understand how to structure cap tables for optimal exit scenarios. Perfect for founders planning Series A+ rounds or managing complex equity situations.

#CapTable, #StartupAdvice, #Founders, #EquityManagement, #StartupFunding, #VentureCapital, #FounderEquity, #SeriesA, #StartupStrategy, #EquityOptimization, #ExitPlanning, #StartupLegal, #FounderTips, #DilutionStrategy, #EquityNegotiation

Advanced Startup Storytelling | How to Craft Multi-Stakeholder Narratives That Scale

Building on storytelling fundamentals, this advanced episode reveals how sophisticated founders craft different narratives for different audiences while maintaining consistent core positioning. Learn the multi-layer story framework, discover how to embed defensibility into your narrative, master objection handling within your story structure, and understand how to evolve your narrative as you scale from pre-seed to Series B and beyond.

#StartupStorytelling, #FundraisingStrategy, #InvestorPitch, #StartupAdvice, #Founders, #VentureCapital, #StartupStrategy, #PitchDeck, #InvestorReadiness, #NarrativeStrategy, #StartupMarketing, #FounderTips, #SeriesA, #BusinessStorytelling, #StartupCommunication

Case Study | Inside the Saks Global Debt Spiral

Case Study | Saks Global Series - When Growth Goes Too Far | Inside the Saks Global Debt Spiral

Saks Global’s $2.7B acquisition of Neiman Marcus was pitched as a landmark luxury retail merger. Instead, it has triggered a high-stakes debt spiral. This case study explores how aggressive financing, inflated EBITDA projections, creditor conflict, and operational missteps have pushed one of retail’s most iconic names toward the brink—all within six months of the deal. A cautionary tale of when growth goes too far.

#SaksGlobal, #NeimanMarcus, #RetailFinance, #DistressedDebt, #PrivateEquity, #LuxuryRetail, #MergersAndAcquisitions, #CapitalStructure, #CreditMarkets, #Restructuring, #LeveragedBuyout, #RetailCollapse, #WhenGrowthGoesTooFar, #CapitalCompass, #FinancialEngineering