The Reality of Portfolio Challenges & Down Rounds | Capital Compass Investor Edition

Building on international expansion mastery, this episode reveals how sophisticated investors navigate portfolio companies through challenging periods and complex down round scenarios. Learn advanced early warning detection systems, discover strategic approaches to down round negotiations, master bridge financing vs. new round decision frameworks, and understand how to manage team changes and board dynamics during crisis periods. Perfect for experienced investors who need to protect portfolio value while positioning companies for recovery and future success.

#DownRounds, #AdvancedInvesting, #PortfolioCrisis, #VentureCapital, #InvestorEducation, #PortfolioManagement, #CrisisManagement, #TurnaroundStrategy, #InvestorMastery, #StartupChallenges, #PortfolioRisk, #InvestmentRecovery, #BoardManagement, #StartupRestructuring, #InvestorStrategy, #capitalcompass, #capitalcompassseries, #capitalcompassinvestoredition

Advanced Valuation Strategy | Multi-Round Optimization, Benchmarking, and Strategic Positioning

Building on valuation fundamentals, this advanced episode reveals how sophisticated founders strategically optimize valuations across multiple rounds while managing complex scenarios like down rounds, international benchmarking, and exit optimization. Learn advanced valuation methodologies, discover sophisticated negotiation frameworks, master multi-round dilution planning, and understand how to position valuations for maximum strategic advantage throughout your company's lifecycle.

#StartupValuation, #AdvancedFunding, #ValuationStrategy, #StartupAdvice, #Founders, #VentureCapital, #SeriesA, #DilutionStrategy, #StartupFunding, #ValuationOptimization, #FundraisingStrategy, #StartupFinance, #InvestorNegotiation, #FounderTips, #CapitalStrategy, #capitalcompass

Preview | Advanced Fundraising Mastery | Multi-Track Deal Management & Strategic Investor Selection

Building on fundraising funnel fundamentals, this advanced episode reveals how sophisticated founders manage multiple investor tracks simultaneously while optimizing for more than just capital. Learn advanced investor psychology techniques, master deal terms negotiation, understand strategic investor selection criteria, and discover how to maintain leverage throughout complex fundraising processes. Perfect for founders ready to raise Series A+ rounds or manage competitive fundraising situations.

#FundraisingStrategy, #StartupAdvice, #Founders, #VentureCapital, #SeriesA, #InvestorRelations, #StartupFunding, #DealTerms, #InvestorPsychology, #CapitalRaising, #StartupStrategy, #Fundraising, #VCFunding, #StartupNegotiation, #InvestorReadiness, #capitalcompass , #capitalcompassinvestoredition, #seriescapitalcompass , #seriescapitalcompassinvestoredition

Advanced Fundraising Mastery | Multi-Track Deal Management and Strategic Investor Selection

Building on fundraising funnel fundamentals, this advanced episode reveals how sophisticated founders manage multiple investor tracks simultaneously while optimizing for more than just capital. Learn advanced investor psychology techniques, master deal terms negotiation, understand strategic investor selection criteria, and discover how to maintain leverage throughout complex fundraising processes. Perfect for founders ready to raise Series A+ rounds or manage competitive fundraising situations.

#FundraisingStrategy, #StartupAdvice, #Founders, #VentureCapital, #SeriesA, #InvestorRelations, #StartupFunding, #DealTerms, #InvestorPsychology, #CapitalRaising, #StartupStrategy, #Fundraising, #VCFunding, #StartupNegotiation, #InvestorReadiness, #capitalcompass

Preview | Term Sheet Psychology - Negotiating Win-Win Deals | Investor Edition

Building on efficient due diligence, this episode reveals how to structure deals that motivate founders while protecting investor interests. Learn the psychology behind founder decision-making during negotiations, master the key terms beyond valuation that drive long-term success, discover common negotiation mistakes that destroy relationships, and understand how to create win-win structures that align interests for maximum value creation. Perfect for investors who want to win competitive deals while setting up portfolio companies for success.

#TermSheet, #StartupNegotiation, #AngelInvesting, #VentureCapital, #DealStructure, #InvestorEducation, #StartupInvesting, #InvestmentTerms, #FounderRelations, #EarlyStageInvesting, #VCFundamentals, #StartupDeals, #InvestorTips, #DealNegotiation, #StartupFunding, #capitalcompass, #capitalcompassinvestoredition, #seriescapitalcompass, #seriescapitalcompassinvestoredition

Preview | Efficient Due Diligence Framework for Investors | Investor Edition

Building on rapid startup evaluation, this episode reveals how to conduct thorough but time-efficient due diligence for promising opportunities. Learn the 80/20 framework for startup due diligence, master financial model analysis for pre-revenue companies, discover reference checking strategies that actually work, and understand what founders expect from professional investors during the diligence process. Perfect for investors who want to be thorough without losing deals to faster competitors.

#DueDiligence, #StartupInvesting, #AngelInvesting, #VentureCapital, #InvestmentDecisions, #StartupAnalysis, #InvestorEducation, #EarlyStageInvesting, #StartupScreening, #InvestmentProcess, #VCFundamentals, #StartupEvaluation, #InvestorTips, #DealAnalysis, #StartupFinance, #capitalcompass, #capitalcompassinvestoredition, #seriescapitalcompass, #seriescapitalcompassinvestoredition

Preview | Rapid Startup Evaluation Framework | Investor Edition

Building on systematic deal flow, this episode reveals how to quickly separate promising opportunities from time-wasters. Learn the 5-minute pitch evaluation framework, discover the red flags that indicate immediate passes, master the green flags that warrant deeper investigation, and understand how founders really think about first investor meetings. Perfect for investors who want to optimize their time while avoiding missed opportunities.

#StartupEvaluation, #AngelInvesting, #VentureCapital, #DueDiligence, #InvestmentDecisions, #StartupInvesting, #InvestorEducation, #PitchEvaluation, #EarlyStageInvesting, #StartupAnalysis, #InvestmentCriteria, #VCFundamentals, #StartupScreening, #InvestorTips, #DealEvaluation, #capitalcompass, #capitalcompassinvestoredition, #seriescapitalcompass

Preview | Deal Flow Architecture - Building Your Startup Pipeline | Investor Edition | Capital Compass

Welcome to Capital Compass: Investor Edition. In this inaugural episode, we explore how to build systematic deal flow that goes beyond your immediate network. Learn the five-pillar deal flow architecture, discover how to attract high-quality founders to you, master geographic and sector focus strategies, and understand what founders really look for when choosing investors. Perfect for new angels, junior VCs, and operators transitioning into investing.

#AngelInvesting, #VentureCapital, #DealFlow, #StartupInvesting, #InvestorEducation, #AngelInvestor, #VCFundamentals, #StartupEcosystem, #InvestmentStrategy, #EarlyStageInvesting, #InvestorRelations, #StartupFunding, #VentureInvesting, #InvestorTips, #DealSourcing, #CapitalCompass, #CapitalCompassInvestorEdition, #capitalcompass, #capitalcompassinvestoredition, #capitalcompass, #capitalcompassinvestoredition, #seriescapitalcompass, #seriescapitalcompassinvestoredition

Investor Edition | The Art of Competitive Rounds - Winning Deals in Hot Markets

Building on pattern recognition mastery, this episode reveals how sophisticated investors win competitive deals without destroying economics or relationships. Learn advanced differentiation strategies beyond valuation, discover how to leverage speed and relationship advantages, master pre-emption tactics that avoid competitive situations entirely, and understand the psychology of founder decision-making when multiple sophisticated investors are competing. Perfect for experienced investors operating in competitive markets where deal-winning capability determines access to the best opportunities.

#CompetitiveDeals, #AdvancedInvesting, #VentureCapital, #AngelInvesting, #DealWinning, #InvestorStrategy, #StartupNegotiation, #InvestmentCompetition, #DealDifferentiation, #InvestorEducation, #VentureStrategy, #StartupFunding, #InvestorRelations, #DealExecution, #InvestorMastery, #capitalcompass, #capitalcompassinvestoredition, #seriescapitalcompass, #seriescapitalcompassinvestoredition

Investor Edition | Pattern Recognition - Identifying Billion-Dollar Opportunities

Welcome to the Advanced Investor Series. This episode reveals how sophisticated investors develop pattern recognition to spot massive opportunities before they become obvious to the market. Learn the technology wave prediction framework, discover how to differentiate between market expansion and market creation opportunities, master the timing analysis that separates early from too early, and understand the founder and business model patterns that predict exceptional outcomes. Perfect for experienced investors ready to develop institutional-quality pattern recognition capabilities.

#PatternRecognition, #AdvancedInvesting, #VentureCapital, #AngelInvesting, #InvestmentStrategy, #StartupTrends, #TechnologyInvesting, #MarketTiming, #InvestorEducation, #TechnologyWaves, #InvestmentThesis, #StartupPatterns, #EarlyStageInvesting, #InnovationInvesting, #InvestorMastery, #capitalcompass, #capitalcompassinvestoredition, #seriescapitalcompass, #seriescapitalcompassinvestoredition

Investor Edition | Post-Investment - Setting Up Portfolio Companies for Success

Completing the investor fundamentals series, this episode reveals how to transition from deal-maker to value-add partner in the critical first 90 days after investment. Learn the investor onboarding framework that builds strong founder relationships, discover how to identify and deliver immediate value, master communication cadence and board preparation, and understand what founders really need from investors to accelerate their success. Perfect for investors who want to maximize portfolio company performance through strategic support.

#PostInvestment, #InvestorOnboarding, #PortfolioSupport, #AngelInvesting, #VentureCapital, #ValueAddInvestor, #FounderRelations, #InvestorEducation, #PortfolioManagement, #BoardEffectiveness, #StartupSupport, #InvestorTips, #EarlyStageInvesting, #PortfolioValue, #InvestmentPartnerships, #capitalcompass, #capitalcompassinvestoredition, #capitalcompass, #capitalcompassinvestoredition, #seriescapitalcompass, #seriescapitalcompassinvestoredition

Investor Edition | The Check Size Strategy - Portfolio Construction

Building on deal structuring mastery, this episode reveals how to construct portfolios that optimize for risk-adjusted returns while maximizing impact per investment. Learn the mathematical foundations of early-stage portfolio construction, discover sophisticated check sizing strategies, master diversification frameworks that actually work, and understand how to balance concentration vs. diversification for different investor profiles. Perfect for investors ready to think systematically about capital allocation across multiple opportunities.

#PortfolioConstruction, #AngelInvesting, #VentureCapital, #InvestmentStrategy, #CheckSizing, #RiskManagement, #InvestorEducation, #PortfolioDiversification, #EarlyStageInvesting, #InvestmentAllocation, #VCFundamentals, #AngelStrategy, #InvestorTips, #CapitalAllocation, #StartupInvesting, #capitalcompass, #capitalcompassinvestoredition, #capitalcompass, #capitalcompassinvestoredition, #seriescapitalcompass, #seriescapitalcompassinvestoredition

Investor Edition | Term Sheet Psychology - Negotiating Win-Win Deals | Capital Compass Series

Building on efficient due diligence, this episode reveals how to structure deals that motivate founders while protecting investor interests. Learn the psychology behind founder decision-making during negotiations, master the key terms beyond valuation that drive long-term success, discover common negotiation mistakes that destroy relationships, and understand how to create win-win structures that align interests for maximum value creation. Perfect for investors who want to win competitive deals while setting up portfolio companies for success.

#TermSheet, #StartupNegotiation, #AngelInvesting, #VentureCapital, #DealStructure, #InvestorEducation, #StartupInvesting, #InvestmentTerms, #FounderRelations, #EarlyStageInvesting, #VCFundamentals, #StartupDeals, #InvestorTips, #DealNegotiation, #StartupFunding, #capitalcompass, #capitalcompassinvestoredition, #seriescapitalcompass, #seriescapitalcompassinvestoredition

Investor Edition | International Expansion Strategy - Helping Portfolio Companies Scale Globally

Building on competitive deal mastery, this episode reveals how sophisticated investors support portfolio companies through successful international expansion. Learn advanced market entry frameworks, discover regulatory and compliance navigation strategies, master international team building and partnership development, and understand how to structure global expansion for maximum value creation while minimizing risk. Perfect for experienced investors whose portfolio companies are ready to scale beyond their domestic markets.

#InternationalExpansion, #AdvancedInvesting, #GlobalStrategy, #VentureCapital, #PortfolioSupport, #InvestorEducation, #StartupGrowth, #GlobalScaling, #InternationalBusiness, #MarketEntry, #InvestorValue, #PortfolioManagement, #GlobalMarkets, #InvestorMastery, #StartupInternationalization, #capitalcompass, #capitalcompassinvestoredition, #seriescapitalcompass, #seriescapitalcompassinvestoredition

Risk vs. Volatility & the Power of Concentration | Buffett's 1993 Investment Philosophy Masterclass

In this episode, we are exploring Warren Buffett's 1993 letter to Berkshire Hathaway shareholders – a letter that delivers some of the most profound insights on investment risk, market volatility, and the power of concentrated investing ever written.

This letter is legendary for dismantling the academic theory that equates volatility with risk, introducing Ben Graham's "Mr. Market" concept to a broader audience, and delivering the most compelling case for concentration over diversification in investment literature. We also get the incredible Coca-Cola historical example that shows the power of patient capital.

We'll explore why volatility is actually the investor's friend, how to think about real business risk versus academic risk measures, why concentration can reduce rather than increase risk, and how competitive moats create long-term wealth. Plus, we'll hear about Mrs. B celebrating her 100th birthday by postponing her party so the store could stay open!

Most importantly, this letter provides a complete framework for thinking about investment risk that remains as relevant today as it was 30 years ago.

#WarrenBuffett, #CharlieMunger, #BerkshireHathaway, #InvestmentRisk, #Volatility, #Beta, #MrMarket, #BenGraham, #ConcentratedInvesting, #CompetitiveMoat, #CocaCola, #LongTermInvesting, #BusinessAnalysis, #InvestmentPhilosophy, #PatientCapital, #QualityBusiness, #CircleOfCompetence, #VotingMachine, #WeighingMachine, #RiskManagement, #ValueInvesting, #CapitalAllocation, #InvestmentWisdom, #WealthBuilding, #SmartMoney, #InvestorEducation, #FinancialLiteracy, #StockMarket, #InvestmentStrategy, #InvestmentLegends

Investor Edition | Efficient Due Diligence Framework for Investors

Building on rapid startup evaluation, this episode reveals how to conduct thorough but time-efficient due diligence for promising opportunities. Learn the 80/20 framework for startup due diligence, master financial model analysis for pre-revenue companies, discover reference checking strategies that actually work, and understand what founders expect from professional investors during the diligence process. Perfect for investors who want to be thorough without losing deals to faster competitors.

#DueDiligence, #StartupInvesting, #AngelInvesting, #VentureCapital, #InvestmentDecisions, #StartupAnalysis, #InvestorEducation, #EarlyStageInvesting, #StartupScreening, #InvestmentProcess, #VCFundamentals, #StartupEvaluation, #InvestorTips, #DealAnalysis, #StartupFinance, #capitalcompass, #capitalcompassinvestoredition, #seriescapitalcompass, #seriescapitalcompassinvestoredition

Investor Edition | Rapid Startup Evaluation Framework

Building on systematic deal flow, this episode reveals how to quickly separate promising opportunities from time-wasters. Learn the 5-minute pitch evaluation framework, discover the red flags that indicate immediate passes, master the green flags that warrant deeper investigation, and understand how founders really think about first investor meetings. Perfect for investors who want to optimize their time while avoiding missed opportunities.

#StartupEvaluation, #AngelInvesting, #VentureCapital, #DueDiligence, #InvestmentDecisions, #StartupInvesting, #InvestorEducation, #PitchEvaluation, #EarlyStageInvesting, #StartupAnalysis, #InvestmentCriteria, #VCFundamentals, #StartupScreening, #InvestorTips, #DealEvaluation, #capitalcompass, #capitalcompassinvestoredition, #seriescapitalcompass

Investor Edition | Deal Flow Architecture | Building Your Startup Pipeline

Welcome to Capital Compass: Investor Edition. In this inaugural episode, we explore how to build systematic deal flow that goes beyond your immediate network. Learn the five-pillar deal flow architecture, discover how to attract high-quality founders to you, master geographic and sector focus strategies, and understand what founders really look for when choosing investors. Perfect for new angels, junior VCs, and operators transitioning into investing.

#AngelInvesting, #VentureCapital, #DealFlow, #StartupInvesting, #InvestorEducation, #AngelInvestor, #VCFundamentals, #StartupEcosystem, #InvestmentStrategy, #EarlyStageInvesting, #InvestorRelations, #StartupFunding, #VentureInvesting, #InvestorTips, #DealSourcing, #CapitalCompass, #CapitalCompassInvestorEdition

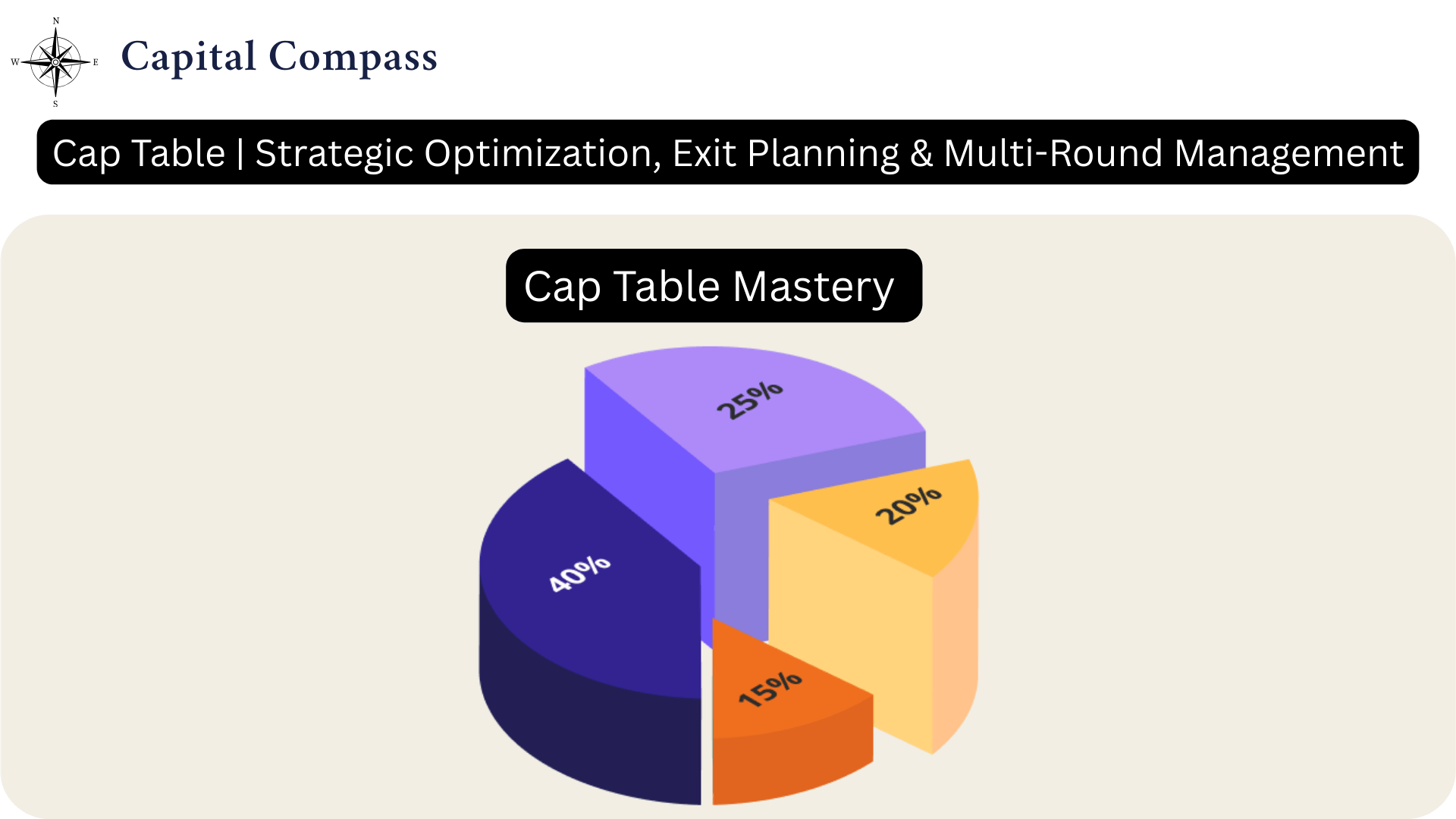

Advanced Cap Table Mastery | Strategic Optimization, Exit Planning, and Multi-Round Management

Building on cap table fundamentals, this advanced episode reveals how sophisticated founders strategically manage equity across multiple funding rounds while optimizing for maximum exit value. Learn advanced dilution modeling, discover equity negotiation strategies that preserve founder control, master complex option pool management, and understand how to structure cap tables for optimal exit scenarios. Perfect for founders planning Series A+ rounds or managing complex equity situations.

#CapTable, #StartupAdvice, #Founders, #EquityManagement, #StartupFunding, #VentureCapital, #FounderEquity, #SeriesA, #StartupStrategy, #EquityOptimization, #ExitPlanning, #StartupLegal, #FounderTips, #DilutionStrategy, #EquityNegotiation

Advanced Startup Storytelling | How to Craft Multi-Stakeholder Narratives That Scale

Building on storytelling fundamentals, this advanced episode reveals how sophisticated founders craft different narratives for different audiences while maintaining consistent core positioning. Learn the multi-layer story framework, discover how to embed defensibility into your narrative, master objection handling within your story structure, and understand how to evolve your narrative as you scale from pre-seed to Series B and beyond.

#StartupStorytelling, #FundraisingStrategy, #InvestorPitch, #StartupAdvice, #Founders, #VentureCapital, #StartupStrategy, #PitchDeck, #InvestorReadiness, #NarrativeStrategy, #StartupMarketing, #FounderTips, #SeriesA, #BusinessStorytelling, #StartupCommunication