Advanced Startup Storytelling | How to Craft Multi-Stakeholder Narratives That Scale

Building on storytelling fundamentals, this advanced episode reveals how sophisticated founders craft different narratives for different audiences while maintaining consistent core positioning. Learn the multi-layer story framework, discover how to embed defensibility into your narrative, master objection handling within your story structure, and understand how to evolve your narrative as you scale from pre-seed to Series B and beyond.

#StartupStorytelling, #FundraisingStrategy, #InvestorPitch, #StartupAdvice, #Founders, #VentureCapital, #StartupStrategy, #PitchDeck, #InvestorReadiness, #NarrativeStrategy, #StartupMarketing, #FounderTips, #SeriesA, #BusinessStorytelling, #StartupCommunication

Advanced Go-To-Market Strategy | Building Multi-Channel Growth Engines That Scale

Building on GTM fundamentals and the CAC/LTV/Payback triangle, this advanced episode reveals how sophisticated founders build multi-channel growth engines that scale efficiently. Learn the channel hierarchy framework, discover advanced CAC optimization techniques, master cohort-based LTV analysis, and understand how to sequence channel investments for maximum capital efficiency. Explore GTM evolution strategies and advanced metrics that Series A+ investors expect to see.

#GoToMarket, #StartupStrategy, #CustomerAcquisition, #StartupAdvice, #Founders, #GTMStrategy, #LTV, #CAC, #StartupGrowth, #ScaleupStrategy, #CustomerRetention, #StartupMetrics, #SeriesA, #GrowthStrategy, #StartupFunding

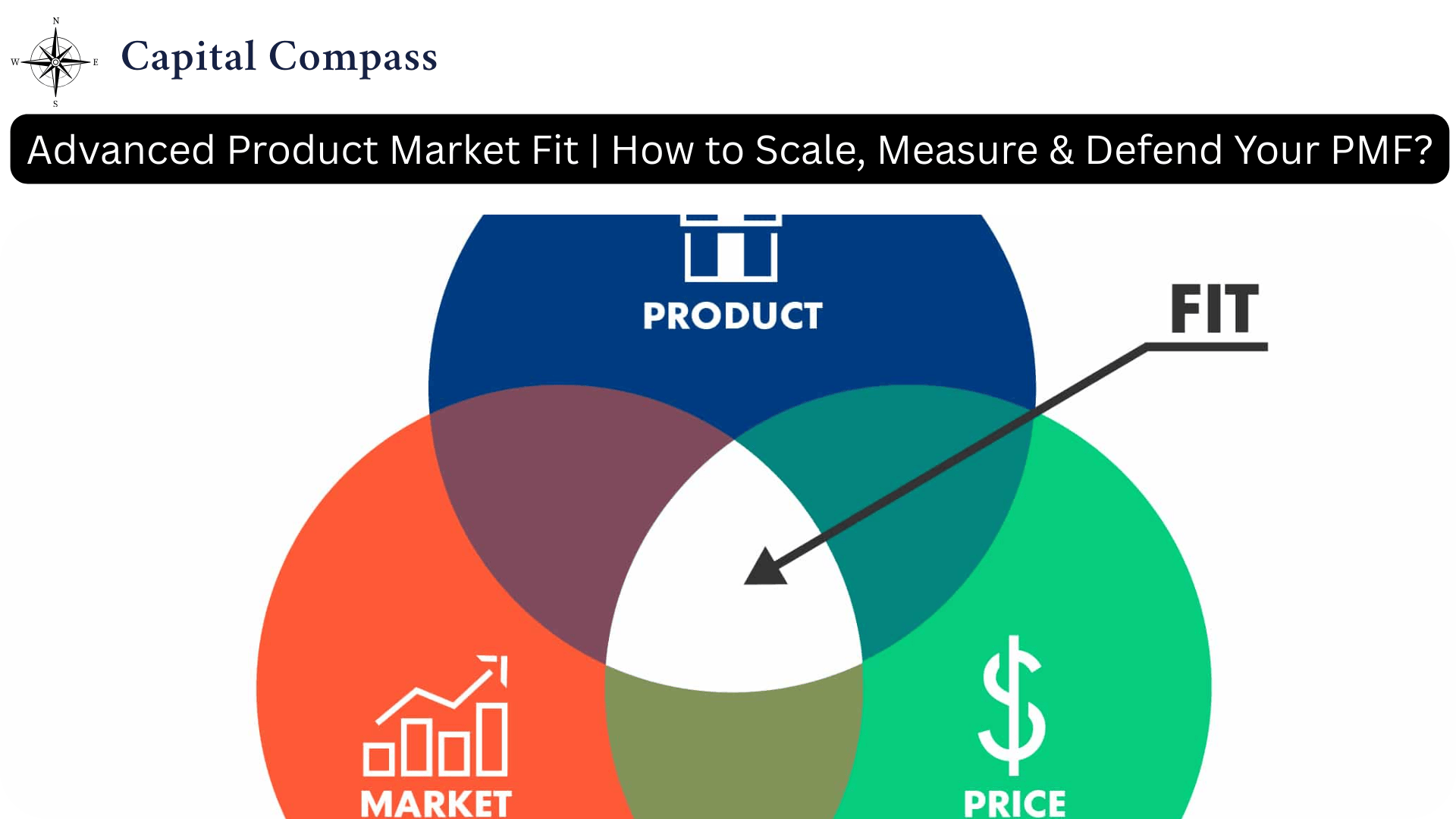

Advanced Product Market Fit | How to Scale, Measure & Defend Your PMF?

Moving beyond the binary thinking of "having" product-market fit, this advanced episode reveals PMF as a spectrum with three distinct levels. Learn the sophisticated measurement framework with six key metrics that Series A+ investors expect, discover how to segment PMF across customer types, and understand the three defense mechanisms that create competitive moats. Master the art of communicating PMF to investors with specific data points and navigate the challenges of maintaining PMF as you scale.

#ProductMarketFit, #StartupAdvice, #Founders, #PMF, #Entrepreneurship, #StartupFunding, #SeriesA, #StartupMetrics, #CustomerRetention, #StartupStrategy, #VentureCapital, #StartupGrowth, #CustomerDevelopment, #CompetitiveAdvantage, #InvestorReadiness, #CapitalCompass

Cash Flow Mastery | Strategic Cash Management for Scale & Competitive Advantage

Taking cash flow optimization to the highest level, this episode transforms cash management from a survival tool into a strategic weapon. Learn advanced forecasting techniques, discover how to use cash flow timing as competitive advantage, master international cash management, and understand how sophisticated investors evaluate cash flow quality. Explore cash flow scenario planning, strategic cash deployment, and how to build cash flow narratives that command premium valuations in later-stage funding rounds.

#CashFlowMastery, #StartupAdvice, #Founders, #StrategicFinance, #Entrepreneurship, #StartupFunding, #ScaleupStrategy, #CapitalEfficiency, #BusinessGrowth, #CFO, #FinancialStrategy, #SeriesB, #StartupFinance, #CashManagement, #StrategicAdvantage, #CapitalCompass

Market Pessimism & the Art of Patient Capital | Buffett's 1990 Investment Masterclass

Warren Buffett's 1990 letter arrives during economic uncertainty and demonstrates masterful contrarian investing. Writing during the savings and loan crisis and economic recession, Buffett uses market pessimism to make exceptional investments, most notably a major stake in Wells Fargo when banking stocks were being shunned.

The letter refines the "look-through earnings" concept, showing how to measure true earning power beyond reported dividends. Buffett delivers a prescient warning about junk bond mania, explaining how excessive leverage creates business fragility. His investment in Wells Fargo during industry-wide panic exemplifies how extraordinary opportunities arise when quality companies face unwarranted pessimism.

#WarrenBuffett, #CharlieMunger, #BerkshireHathaway, #ContrarianInvesting, #MarketPessimism, #WellsFargo, #LookThroughEarnings, #JunkBonds, #FinancialEngineering, #ValueInvesting, #InsuranceFloat, #PatientCapital, #MarginOfSafety, #BusinessQuality, #ManagementExcellence, #LongTermInvesting, #InvestmentPhilosophy, #CompetitiveAdvantage, #CapitalAllocation, #ContrarianThinking, #InvestmentWisdom, #FinancialAlchemy, #WealthBuilding, #SmartMoney, #InvestorEducation, #FinancialLiteracy, #StockMarket, #InvestmentStrategy, #InvestmentLegends

The Sainted Seven and Forever Investing | Buffett's 1988 Investment Masterpiece

Warren Buffett's 1988 letter demonstrates the power of combining exceptional businesses with exceptional management through his "Sainted Seven" companies that achieved an extraordinary 67% return on equity capital. This letter marks Buffett's famous Coca-Cola investment and articulates his "forever investing" philosophy - holding great businesses indefinitely rather than trading them.

#WarrenBuffett, #CharleMunger, #BerkshireHathaway, #CocaCola, #SaintedSeven, #ForeverInvesting, #ValueInvestment, #EfficientMarketTheory, #Arbitrage, #BusinessAnalysis, #LongTermInvesting, #ConcentratedInvesting, #CapitalAllocation, #ReturnOnEquity, #InvestmentPhilosophy, #FreddeMac, #Borsheims, #InvestorEducation, #MarketEfficiency, #BusinessQuality, #CompetitiveAdvantage, #CEOPerformance, #CorporateGovernance, #InvestmentStrategy, #WealthBuilding, #SmartMoney, #FinancialWisdom, #StockMarket, #InvestmentLegends

Learning from Mistakes & Financial Alchemy | Buffett's 1989 Investment Evolution

Warren Buffett's 1989 letter marks 25 years of Berkshire Hathaway under his leadership with a remarkable section on "Mistakes of the First Twenty-five Years." This candid self-reflection reveals Buffett's evolution from "cigar butt" investing - buying cheap, mediocre businesses for quick profits - to his mature philosophy of buying wonderful companies at fair prices.

#WarrenBuffett, #CharleMunger, #BerkshireHathaway, #InvestmentMistakes, #CigarButtInvesting, #CocaCola, #InstitutionalImperative, #ZeroCouponBonds, #FinancialEngineering, #ValueInvestment, #LookThroughEarnings, #InvestmentPhilosophy, #LongTermInvesting, #BusinessQuality, #CapitalAllocation, #InvestmentEvolution, #ConservativeFinance, #LearningFromMistakes, #InvestmentWisdom, #CompetitiveAdvantage, #BusinessAnalysis, #FinancialAlchemy, #WealthBuilding, #SmartMoney, #InvestorEducation, #FinancialLiteracy, #StockMarket, #InvestmentStrategy, #InvestmentLegends

The Art of Rational Investing | Buffett's 1987 Crash Wisdom

Warren Buffett's 1987 letter, written after Black Monday's historic crash, transforms market chaos into investment wisdom through his famous Mr. Market allegory. Instead of viewing volatility as threatening, Buffett teaches us to see it as opportunities created by other investors' emotional swings.

The letter's centerpiece is Ben Graham's Mr. Market concept - imagining market prices as daily offers from an emotionally unstable partner. This reframes market volatility from something to fear into something to exploit, emphasizing that Mr. Market is "there to serve you, not guide you."

#WarrenBuffett, #CharleMunger, #BerkshireHathaway, #MrMarket, #ValueInvestment, #StockMarketCrash, #InvestmentPhilosophy, #MarketVolatility, #BusinessAnalysis, #LongTermInvesting, #PermanentHoldings, #BenGraham, #InvestmentStrategy, #MarketPsychology, #PortfolioInsurance, #InvestorEducation, #FinancialWisdom, #StockMarket, #InvestmentPrinciples, #MarketCrash1987, #RationalInvesting, #BusinessOwnership, #CapitalAllocation, #CompetitiveAdvantage, #InvestmentMindset, #WealthBuilding, #SmartMoney, #FinancialLiteracy, #InvestmentLegends

Economic Moats and Market Emotions | Buffett's 1986 Blueprint

Warren Buffett's 1986 letter introduces two of investing's most enduring concepts: economic moats and contrarian market psychology. Despite Berkshire's 26.1% gain, Buffett focuses on the growing challenge of deploying capital in an expensive market.

#WarrenBuffett, #CharleMunger, #BerkshireHathaway, #EconomicMoats, #ValueInvestment, #CompetitiveAdvantage, #InvestmentStrategy, #MarketPsychology, #Contrarian, #BusinessAnalysis, #GEICO, #OwnerEarnings, #CashFlow, #CapitalAllocation, #InvestmentWisdom, #LongTermInvesting, #BusinessMoats, #InvestorEducation, #FinancialLiteracy, #StockMarket, #InvestmentPrinciples, #BusinessStrategy, #WealthBuilding, #SmartMoney, #InvestmentLegends, #BusinessPhilosophy, #MarketSentiment, #RiskManagement, #BusinessOwnership

Choose Your Business Boat Wisely | Buffett's 1985 Wake-Up Call

Warren Buffett's 1985 letter delivers brutal honesty about business realities alongside timeless investment wisdom. Despite Berkshire's spectacular 48.2% gain, Buffett warns that size will inevitably dampen future returns - a mathematical inevitability he calls the "iron law of business."

#WarrenBuffett, #CharleMunger, #BerkshireHathaway, #ValueInvestment, #BusinessWisdom, #InvestmentStrategy, #StockMarket, #BusinessPhilosophy, #InvestorEducation, #FinancialLiteracy, #InvestmentAdvice, #CompoundInterest, #BusinessAnalysis, #MarketInsights, #LongTermInvesting, #CapitalAllocation, #BusinessStrategy, #InvestmentPrinciples, #WealthBuilding, #SmartMoney, #InvestmentLegends, #BusinessLessons, #ExecutiveCompensation, #IndustryAnalysis, #AssetAllocation, #RiskManagement, #InvestmentMindset, #BusinessOwnership, #EconomicMoats, #CompetitiveAdvantage

Understanding Goodwill | Warren Buffett's Deep Dive

Goodwill and Its Amortization (1984 Berkshire Hathaway Letter, Appendix) In this powerful appendix, Warren Buffett breaks down the difference between accounting Goodwill and economic Goodwill. Accounting Goodwill is created when a company pays more for a business than its tangible assets are worth — and then amortizes that difference over time, even though the real economic value may be growing.

#WarrenBuffett, #CharlieMunger, #Goodwill, #AccountingVsEconomics, #ShareholderLetters, #ValueInvesting, #IntangibleAssets, #InflationHedge, #See’sCandies, #FinancialLiteracy, #InvestmentStrategy, #BuffettWisdom, #CapitalAllocation, #OwnerMindset, #LongTermThinking

Stock Splits, Issuance & Owner Discipline | 1984 Shareholder Letter

In the 1984 shareholder letter, Warren Buffett dismantles several common corporate practices — like stock splits, excessive trading, and overvalued acquisitions — arguing they often harm long-term shareholders.

He stresses that issuing undervalued stock is equivalent to selling the business too cheap, diluting long-term value. Similarly, stock splits attract short-term traders, not thoughtful owners, distorting shareholder quality and market behavior.

#WarrenBuffett, #CharlieMunger, #BerkshireHathaway, #StockSplits, #CapitalDiscipline, #ShareholderLetters, #ValueInvesting, #OwnerMindset, #StockIssuance, #BuffettWisdom, #LongTermThinking, #FinancialLiteracy, #CorporateGovernance, #MarketVolatility, #InvestmentPhilosophy

Shareholder Letter: 1983 | Equity Issuance

In the 1983 letter, Warren Buffett delivers a masterclass on when — and when not — to issue shares. At the core is a deceptively simple rule: “We will not issue shares unless we receive as much intrinsic business value as we give.” Buffett explains that stock, like cash, is currency. And using undervalued stock to acquire a fairly priced business is equivalent to trading dollar bills for fifty-cent pieces — a destruction of shareholder value.

#WarrenBuffett, #BerkshireHathaway, #EquityIssuance, #CapitalAllocation, #ShareholderValue, #ValueInvesting, #BuffettQuotes, #IntrinsicValue, #MergersAndAcquisitions, #CorporateGovernance, #FinancialWisdom, #StockMarket, #BusinessStrategy, #OwnerMindset, #InvestmentDiscipline, #CapitalCompass, #FinancialLiteracy, #LongTermThinking

Shareholder Letter: 1982 | “Toads, Princes & the Tapeworm of Inflation"

In the 1982 letter, Warren Buffett emphasizes the power of owning small stakes in high-quality businesses rather than overpaying for full control. He critiques the flawed logic behind high-premium acquisitions, likening them to “kissing toads,” and praises managers who resist empire-building in favor of shareholder returns.

#WarrenBuffett, #CharlieMunger, #BerkshireHathaway, #ShareholderLetters, #ValueInvesting, #Inflation, #CapitalAllocation, #MergersAndAcquisitions, #CorporateGovernance, #EquityReturns, #InvestmentWisdom, #BusinessStrategy, #BuffettQuotes, #LongTermThinking, #FinancialLiteracy

Cubic.dev | AI Code Review That Actually Works | Product Deep Dive

Code review has become the biggest bottleneck in modern software development. As teams adopt AI code generation tools, the problem is getting worse - more code to review, but the same manual process. Cubic.dev is tackling this with AI that performs the first pass of every code review, and the results are impressive: teams merge pull requests 28% faster.

#Cubic, #CodeReview, #AIDevelopment, #SoftwareDevelopment, #DevTools, #YCombinator, #GitHubIntegration, #PullRequests, #DeveloperProductivity, #SoftwareEngineering, #TechReview, #AITools, #DevOps, #SoftwareQuality, #TechStartup, #Programming, #DeveloperTools, #CodeQuality, #TechInnovation, #SoftwareReview, #DeveloperWorkflow, #TechTrends, #StartupTools, #Innovation, #Technology, #AIAssistant, #CodeAnalysis, #TechEducation, #SoftwareTeams, #DeveloperExperience

Bubble.io | The Full-Stack No-Code Platform | Product Deep Dive

With over 4.69 million applications built and users collectively raising $15 billion through their projects, Bubble.io represents one of the most established players in the no-code movement. But is it right for your next project? Let's dive deep into what makes this platform tick.

#Bubble, #NoCode, #WebDevelopment, #AppDevelopment, #NoCodePlatform, #SaaS, #Startup, #Entrepreneurship, #TechReview, #WebApps, #NoCodeTools, #BusinessTools, #Productivity, #TechInnovation, #SoftwareDevelopment, #VisualProgramming, #DatabaseManagement, #API, #TechStartup, #MVPDevelopment, #DigitalProducts, #TechTrends, #Innovation, #Technology, #AppBuilder, #WebAppDevelopment, #TechPlatform, #BusinessInnovation, #SoftwareReview, #TechEducation

Atlas | No-Code Billing for Modern Tech Companies | Product Deep Dive

As tech products get more sophisticated, their pricing models have evolved far beyond simple monthly subscriptions. AI companies charge per API call, IoT devices bill based on usage, SaaS platforms need hybrid models. Atlas is building the billing infrastructure for this new reality.

#Atlas, #BillingPlatform, #NoCode, #SaaS, #UsageBasedBilling, #TechInfrastructure, #FinTech, #B2BSoftware, #StartupTools, #BillingAutomation, #PricingStrategy, #RevenueOperations, #TechReview, #AICompanies, #IoT, #ModernBilling, #SubscriptionBilling, #TechStartup, #BusinessTools, #PaymentProcessing, #TechInnovation, #SoftwareReview, #EnterpriseSoftware, #TechTrends, #ProductReview, #BusinessInfrastructure, #TechPlatform, #Innovation, #Technology, #StartupInfrastructure

DeckSpeed | AI Presentations Through Conversation | Product Deep Dive

Tired of browsing templates and wrestling with slide layouts? DeckSpeed takes a completely different approach to presentation creation - you simply describe what you need in conversation, and AI builds your presentation from scratch. No templates, no design decisions, just natural language to polished slides.

#DeckSpeed, #AIPresentations, #ConversationalAI, #PresentationTools, #ArtificialIntelligence, #NoDesignSkills, #BusinessTools, #Productivity, #SaaS, #TechReview, #AITools, #PresentationMaker, #TechInnovation, #StartupTools, #WorkflowOptimization, #AI, #TechTrends, #Innovation, #Technology, #ProductivityTools, #BusinessPresentation, #SlideDesign, #AutomatedDesign, #TechStartup, #SoftwareReview, #CreativeAI, #PresentationSoftware, #TechProductReview, #AIAssistant, #ModernWorkflow

Tapflow.ai | Turn Your Tech Knowledge Into Income | Product Deep Dive

Ever feel like your years of tech expertise should be earning you more? Tapflow.ai is designed specifically for tech professionals who want to monetize their knowledge by creating sellable digital products. From design systems to AI implementation frameworks, your everyday expertise might be more valuable than you think.

#Tapflow, #KnowledgeMonetization, #TechProfessionals, #DigitalProducts, #SideHustle, #OnlineCourses, #NoCode, #SaaS, #ProductivityTools, #TechEntrepreneurs, #PassiveIncome, #ContentCreation, #SkillMonetization, #TechSkills, #Freelancing, #TechBusiness, #OnlineBusiness, #DigitalEntrepreneur, #TechInnovation, #StartupTools, #RemoteWork, #TechReview, #ProductHunt, #IndieHackers, #TechStartup, #Innovation, #Technology, #BusinessTools, #CreatorEconomy, #TechTrends

Memories.ai | The AI That Never Forgets Your Videos | Product Deep Dive

What if you could chat with your entire video library like talking to a person? Ask questions, get instant answers, and find any moment across thousands of hours of footage. That's exactly what memories.ai has built - and it's revolutionizing how we interact with video content.

#MemoriesAI, #ArtificialIntelligence, #AI, #VideoAnalysis, #MachineLearning, #ComputerVision, #Startup, #TechReview, #ProductReview, #SaaS, #VideoTechnology, #AIMemory, #SecurityTech, #MarketingTech, #ContentCreation, #TechInnovation, #AITools, #VideoSearch, #FutureTech, #TechStartup, #AIAgents, #VideoAI, #TechTrends, #Innovation, #Technology, #AIProduct, #LargeLanguageModels, #VideoMarketing, #TechAnalysis