Preview | Risk vs. Volatility & the Power of Concentration | Buffett's 1993 Investment Philosophy Masterclass

The 1993 letter delivers timeless wisdom about the nature of investment risk and the power of focusing on business fundamentals rather than market noise. Buffett's insights about volatility being the investor's friend and concentration reducing risk for knowledgeable investors remain as relevant today as ever.

Most importantly, this letter shows that successful investing isn't about predicting market movements or solving complex puzzles – it's about finding simple, understandable businesses with strong competitive positions and having the patience to let compounding work its magic.

#WarrenBuffett, #CharlieMunger, #BerkshireHathaway, #InvestmentRisk, #Volatility, #Beta, #MrMarket, #BenGraham, #ConcentratedInvesting, #CompetitiveMoat, #CocaCola, #LongTermInvesting, #BusinessAnalysis, #InvestmentPhilosophy, #PatientCapital, #QualityBusiness, #CircleOfCompetence, #VotingMachine, #WeighingMachine, #RiskManagement, #ValueInvesting, #CapitalAllocation, #InvestmentWisdom, #WealthBuilding, #SmartMoney, #InvestorEducation, #FinancialLiteracy, #StockMarket, #InvestmentStrategy, #InvestmentLegends

Risk vs. Volatility & the Power of Concentration | Buffett's 1993 Investment Philosophy Masterclass

In this episode, we are exploring Warren Buffett's 1993 letter to Berkshire Hathaway shareholders – a letter that delivers some of the most profound insights on investment risk, market volatility, and the power of concentrated investing ever written.

This letter is legendary for dismantling the academic theory that equates volatility with risk, introducing Ben Graham's "Mr. Market" concept to a broader audience, and delivering the most compelling case for concentration over diversification in investment literature. We also get the incredible Coca-Cola historical example that shows the power of patient capital.

We'll explore why volatility is actually the investor's friend, how to think about real business risk versus academic risk measures, why concentration can reduce rather than increase risk, and how competitive moats create long-term wealth. Plus, we'll hear about Mrs. B celebrating her 100th birthday by postponing her party so the store could stay open!

Most importantly, this letter provides a complete framework for thinking about investment risk that remains as relevant today as it was 30 years ago.

#WarrenBuffett, #CharlieMunger, #BerkshireHathaway, #InvestmentRisk, #Volatility, #Beta, #MrMarket, #BenGraham, #ConcentratedInvesting, #CompetitiveMoat, #CocaCola, #LongTermInvesting, #BusinessAnalysis, #InvestmentPhilosophy, #PatientCapital, #QualityBusiness, #CircleOfCompetence, #VotingMachine, #WeighingMachine, #RiskManagement, #ValueInvesting, #CapitalAllocation, #InvestmentWisdom, #WealthBuilding, #SmartMoney, #InvestorEducation, #FinancialLiteracy, #StockMarket, #InvestmentStrategy, #InvestmentLegends

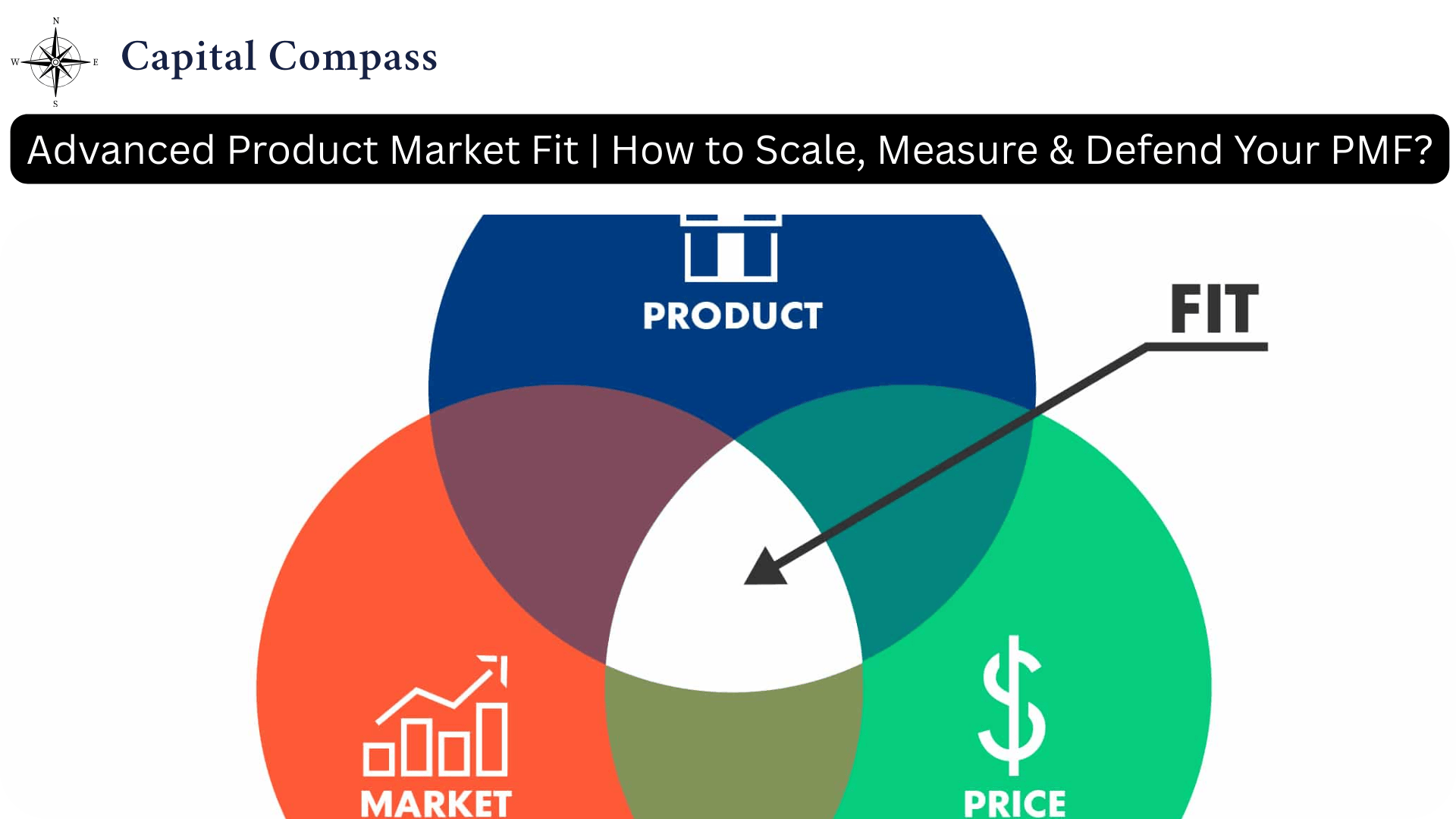

Advanced Product Market Fit | How to Scale, Measure & Defend Your PMF?

Moving beyond the binary thinking of "having" product-market fit, this advanced episode reveals PMF as a spectrum with three distinct levels. Learn the sophisticated measurement framework with six key metrics that Series A+ investors expect, discover how to segment PMF across customer types, and understand the three defense mechanisms that create competitive moats. Master the art of communicating PMF to investors with specific data points and navigate the challenges of maintaining PMF as you scale.

#ProductMarketFit, #StartupAdvice, #Founders, #PMF, #Entrepreneurship, #StartupFunding, #SeriesA, #StartupMetrics, #CustomerRetention, #StartupStrategy, #VentureCapital, #StartupGrowth, #CustomerDevelopment, #CompetitiveAdvantage, #InvestorReadiness, #CapitalCompass

Market Pessimism & the Art of Patient Capital | Buffett's 1990 Investment Masterclass

Warren Buffett's 1990 letter arrives during economic uncertainty and demonstrates masterful contrarian investing. Writing during the savings and loan crisis and economic recession, Buffett uses market pessimism to make exceptional investments, most notably a major stake in Wells Fargo when banking stocks were being shunned.

The letter refines the "look-through earnings" concept, showing how to measure true earning power beyond reported dividends. Buffett delivers a prescient warning about junk bond mania, explaining how excessive leverage creates business fragility. His investment in Wells Fargo during industry-wide panic exemplifies how extraordinary opportunities arise when quality companies face unwarranted pessimism.

#WarrenBuffett, #CharlieMunger, #BerkshireHathaway, #ContrarianInvesting, #MarketPessimism, #WellsFargo, #LookThroughEarnings, #JunkBonds, #FinancialEngineering, #ValueInvesting, #InsuranceFloat, #PatientCapital, #MarginOfSafety, #BusinessQuality, #ManagementExcellence, #LongTermInvesting, #InvestmentPhilosophy, #CompetitiveAdvantage, #CapitalAllocation, #ContrarianThinking, #InvestmentWisdom, #FinancialAlchemy, #WealthBuilding, #SmartMoney, #InvestorEducation, #FinancialLiteracy, #StockMarket, #InvestmentStrategy, #InvestmentLegends

The Sainted Seven and Forever Investing | Buffett's 1988 Investment Masterpiece

Warren Buffett's 1988 letter demonstrates the power of combining exceptional businesses with exceptional management through his "Sainted Seven" companies that achieved an extraordinary 67% return on equity capital. This letter marks Buffett's famous Coca-Cola investment and articulates his "forever investing" philosophy - holding great businesses indefinitely rather than trading them.

#WarrenBuffett, #CharleMunger, #BerkshireHathaway, #CocaCola, #SaintedSeven, #ForeverInvesting, #ValueInvestment, #EfficientMarketTheory, #Arbitrage, #BusinessAnalysis, #LongTermInvesting, #ConcentratedInvesting, #CapitalAllocation, #ReturnOnEquity, #InvestmentPhilosophy, #FreddeMac, #Borsheims, #InvestorEducation, #MarketEfficiency, #BusinessQuality, #CompetitiveAdvantage, #CEOPerformance, #CorporateGovernance, #InvestmentStrategy, #WealthBuilding, #SmartMoney, #FinancialWisdom, #StockMarket, #InvestmentLegends

Learning from Mistakes & Financial Alchemy | Buffett's 1989 Investment Evolution

Warren Buffett's 1989 letter marks 25 years of Berkshire Hathaway under his leadership with a remarkable section on "Mistakes of the First Twenty-five Years." This candid self-reflection reveals Buffett's evolution from "cigar butt" investing - buying cheap, mediocre businesses for quick profits - to his mature philosophy of buying wonderful companies at fair prices.

#WarrenBuffett, #CharleMunger, #BerkshireHathaway, #InvestmentMistakes, #CigarButtInvesting, #CocaCola, #InstitutionalImperative, #ZeroCouponBonds, #FinancialEngineering, #ValueInvestment, #LookThroughEarnings, #InvestmentPhilosophy, #LongTermInvesting, #BusinessQuality, #CapitalAllocation, #InvestmentEvolution, #ConservativeFinance, #LearningFromMistakes, #InvestmentWisdom, #CompetitiveAdvantage, #BusinessAnalysis, #FinancialAlchemy, #WealthBuilding, #SmartMoney, #InvestorEducation, #FinancialLiteracy, #StockMarket, #InvestmentStrategy, #InvestmentLegends

The Art of Rational Investing | Buffett's 1987 Crash Wisdom

Warren Buffett's 1987 letter, written after Black Monday's historic crash, transforms market chaos into investment wisdom through his famous Mr. Market allegory. Instead of viewing volatility as threatening, Buffett teaches us to see it as opportunities created by other investors' emotional swings.

The letter's centerpiece is Ben Graham's Mr. Market concept - imagining market prices as daily offers from an emotionally unstable partner. This reframes market volatility from something to fear into something to exploit, emphasizing that Mr. Market is "there to serve you, not guide you."

#WarrenBuffett, #CharleMunger, #BerkshireHathaway, #MrMarket, #ValueInvestment, #StockMarketCrash, #InvestmentPhilosophy, #MarketVolatility, #BusinessAnalysis, #LongTermInvesting, #PermanentHoldings, #BenGraham, #InvestmentStrategy, #MarketPsychology, #PortfolioInsurance, #InvestorEducation, #FinancialWisdom, #StockMarket, #InvestmentPrinciples, #MarketCrash1987, #RationalInvesting, #BusinessOwnership, #CapitalAllocation, #CompetitiveAdvantage, #InvestmentMindset, #WealthBuilding, #SmartMoney, #FinancialLiteracy, #InvestmentLegends

Economic Moats and Market Emotions | Buffett's 1986 Blueprint

Warren Buffett's 1986 letter introduces two of investing's most enduring concepts: economic moats and contrarian market psychology. Despite Berkshire's 26.1% gain, Buffett focuses on the growing challenge of deploying capital in an expensive market.

#WarrenBuffett, #CharleMunger, #BerkshireHathaway, #EconomicMoats, #ValueInvestment, #CompetitiveAdvantage, #InvestmentStrategy, #MarketPsychology, #Contrarian, #BusinessAnalysis, #GEICO, #OwnerEarnings, #CashFlow, #CapitalAllocation, #InvestmentWisdom, #LongTermInvesting, #BusinessMoats, #InvestorEducation, #FinancialLiteracy, #StockMarket, #InvestmentPrinciples, #BusinessStrategy, #WealthBuilding, #SmartMoney, #InvestmentLegends, #BusinessPhilosophy, #MarketSentiment, #RiskManagement, #BusinessOwnership

Choose Your Business Boat Wisely | Buffett's 1985 Wake-Up Call

Warren Buffett's 1985 letter delivers brutal honesty about business realities alongside timeless investment wisdom. Despite Berkshire's spectacular 48.2% gain, Buffett warns that size will inevitably dampen future returns - a mathematical inevitability he calls the "iron law of business."

#WarrenBuffett, #CharleMunger, #BerkshireHathaway, #ValueInvestment, #BusinessWisdom, #InvestmentStrategy, #StockMarket, #BusinessPhilosophy, #InvestorEducation, #FinancialLiteracy, #InvestmentAdvice, #CompoundInterest, #BusinessAnalysis, #MarketInsights, #LongTermInvesting, #CapitalAllocation, #BusinessStrategy, #InvestmentPrinciples, #WealthBuilding, #SmartMoney, #InvestmentLegends, #BusinessLessons, #ExecutiveCompensation, #IndustryAnalysis, #AssetAllocation, #RiskManagement, #InvestmentMindset, #BusinessOwnership, #EconomicMoats, #CompetitiveAdvantage

Understanding Goodwill | Warren Buffett's Deep Dive

Goodwill and Its Amortization (1984 Berkshire Hathaway Letter, Appendix) In this powerful appendix, Warren Buffett breaks down the difference between accounting Goodwill and economic Goodwill. Accounting Goodwill is created when a company pays more for a business than its tangible assets are worth — and then amortizes that difference over time, even though the real economic value may be growing.

#WarrenBuffett, #CharlieMunger, #Goodwill, #AccountingVsEconomics, #ShareholderLetters, #ValueInvesting, #IntangibleAssets, #InflationHedge, #See’sCandies, #FinancialLiteracy, #InvestmentStrategy, #BuffettWisdom, #CapitalAllocation, #OwnerMindset, #LongTermThinking

Stock Splits, Issuance & Owner Discipline | 1984 Shareholder Letter

In the 1984 shareholder letter, Warren Buffett dismantles several common corporate practices — like stock splits, excessive trading, and overvalued acquisitions — arguing they often harm long-term shareholders.

He stresses that issuing undervalued stock is equivalent to selling the business too cheap, diluting long-term value. Similarly, stock splits attract short-term traders, not thoughtful owners, distorting shareholder quality and market behavior.

#WarrenBuffett, #CharlieMunger, #BerkshireHathaway, #StockSplits, #CapitalDiscipline, #ShareholderLetters, #ValueInvesting, #OwnerMindset, #StockIssuance, #BuffettWisdom, #LongTermThinking, #FinancialLiteracy, #CorporateGovernance, #MarketVolatility, #InvestmentPhilosophy

Shareholder Letter: 1983 | Equity Issuance

In the 1983 letter, Warren Buffett delivers a masterclass on when — and when not — to issue shares. At the core is a deceptively simple rule: “We will not issue shares unless we receive as much intrinsic business value as we give.” Buffett explains that stock, like cash, is currency. And using undervalued stock to acquire a fairly priced business is equivalent to trading dollar bills for fifty-cent pieces — a destruction of shareholder value.

#WarrenBuffett, #BerkshireHathaway, #EquityIssuance, #CapitalAllocation, #ShareholderValue, #ValueInvesting, #BuffettQuotes, #IntrinsicValue, #MergersAndAcquisitions, #CorporateGovernance, #FinancialWisdom, #StockMarket, #BusinessStrategy, #OwnerMindset, #InvestmentDiscipline, #CapitalCompass, #FinancialLiteracy, #LongTermThinking

Shareholder Letter: 1982 | “Toads, Princes & the Tapeworm of Inflation"

In the 1982 letter, Warren Buffett emphasizes the power of owning small stakes in high-quality businesses rather than overpaying for full control. He critiques the flawed logic behind high-premium acquisitions, likening them to “kissing toads,” and praises managers who resist empire-building in favor of shareholder returns.

#WarrenBuffett, #CharlieMunger, #BerkshireHathaway, #ShareholderLetters, #ValueInvesting, #Inflation, #CapitalAllocation, #MergersAndAcquisitions, #CorporateGovernance, #EquityReturns, #InvestmentWisdom, #BusinessStrategy, #BuffettQuotes, #LongTermThinking, #FinancialLiteracy